In December changes to the domestic and non-domestic RHI were announced, following the consultation launched in Spring 2016. The main surprise is an increase in tariffs for some domestic heating technologies! The changes are expected to come into force in spring 2017, although any system installed between now and then will automatically have the increased tariff applied when this comes in.

The domestic RHI is designed to help householders move away from carbon intensive forms of heating to low-carbon renewable alternatives. It is broadly aimed at those off the gas grid, using oil, LPG, solid fuel or electricity to heat their properties. Once an MCS approved system has been installed by a suitably qualified and registered installer, the homeowner is eligible to apply for the RHI. Once registered, quarterly payments are made based on a ‘deemed’ energy requirement for the property taken from the EPC for 7 years. Householders will need an up to date EPC certificate showing this energy requirement in kWh, it also needs to confirm that a minimum 300mm of loft insulation and cavity wall insulation is present (if cavity walls are present).

Here we aim to look at broadly what the changes mean for those of you looking at a domestic renewable heating installation in the New Year.

On top of very welcome increases in tariffs, the proposed changes to the RHI set a ceiling for the total amount that can be claimed, so that large properties do not benefit from disproportionately high payments and use up large chunks of the budget. It is important to note that this ceiling relates to the heat demand of the property, as with heat pumps payment is only made for the renewable proportion the heat generated to meet this demand.

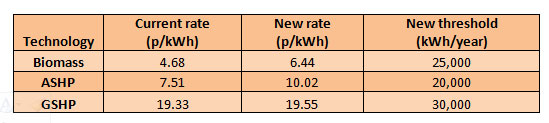

The table below shows the changes to the rates (applicable for systems installed from December 2016) and the proposed limits (expected to apply to systems installed from spring 2017).

For a biomass system the ceiling is 25,000kWh/year, and as all of the heat generated by a biomass boiler is considered renewable you simply multiply this up by the new tariff of 6.44 pence per kWh. This means a maximum payment of £1,610/year, or a total of £11,270 over the 7 years of payments.

For an air source heat pump (ASHP) the ceiling is 20,000kWh/year of heat demand. As a heat pump requires electricity to run, only a proportion of its heat is considered renewable and so eligible for payments. As an example, for a typical ASHP producing 20,000kWh/year of heat, 14,286kWh could be considered renewable, meaning RHI payments of £1,431/year , or a total of £10,020 over the 7 years of payments.

It is the same situation with a ground source heat pump (GSHP), so for a typical GSHP producing 30,000kWh/year of heat, 23,333kWh could be considered renewable, meaning payments of £4,562/year or a total of £31,932 over the 7 years of payments.

The different rates are designed to reflect the different installation costs associated with the technologies, with ground source heat pumps typically costing a lot more to install than ASHP and biomass due to the need for boreholes or large ground arrays.

So if you are considering renewable heating for your property, there hasn’t been a better time in the past couple of years than now! Get in touch with SunGift today to discuss what type of system might be suitable for your property and we will be able to advise, design and install the best system for you.

Solar PV Contractor of the Year 2024

Solar PV Contractor of the Year 2024